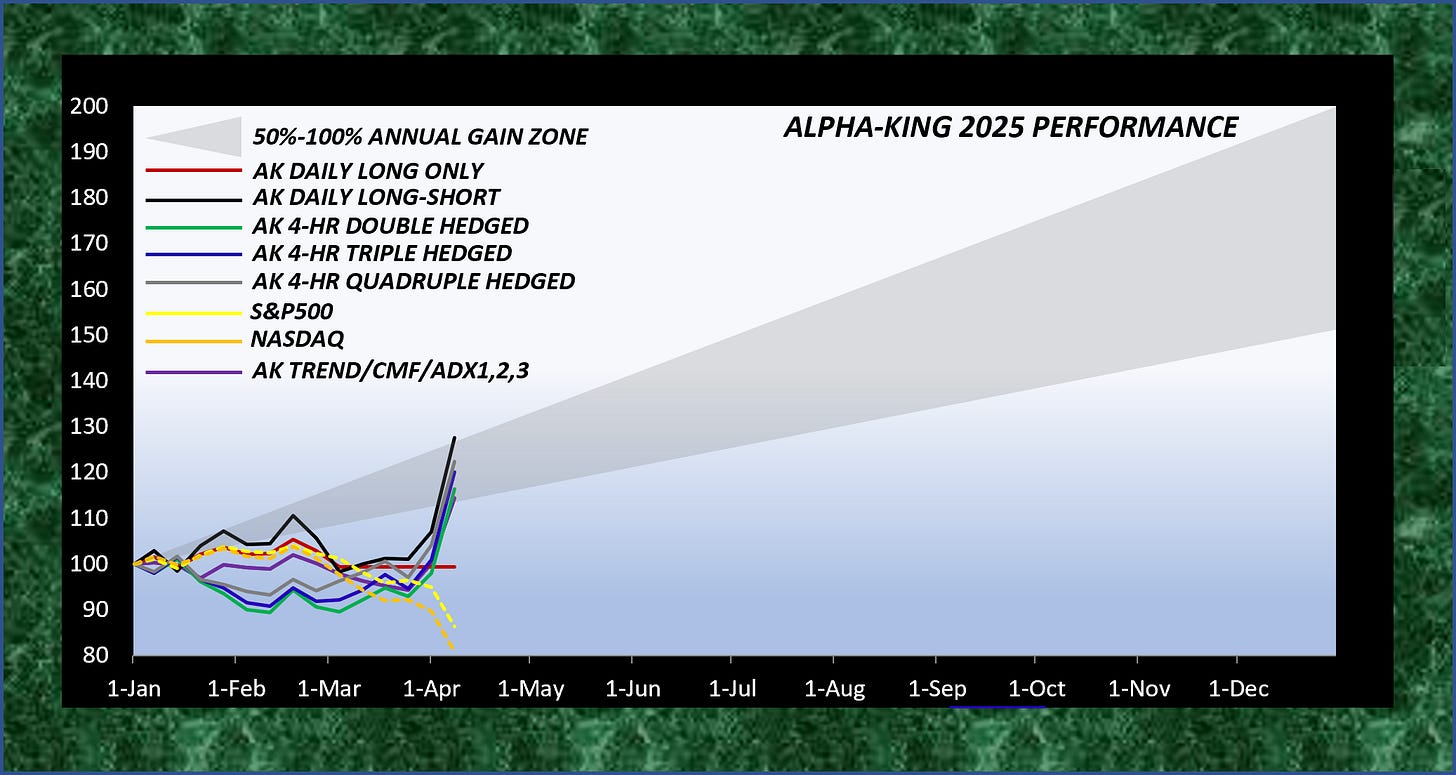

Last year was a tough one for those looking to beat the broader market performance, with buy and holding the S&P500 and NASDAQ indexes paiding off handsomely. That has certainly changed this year, especially after the collapse experienced by the broader index the past month or so.

That difficult times for stocks helped highlight the power of following the trend in multiple time frames, with all stategies outlined in the AK Trading Strategy book outperforming in a big way this year.

Indeed, most of the those strategies currently reside in the target +50 to +100% annual gain zone.

On the strategy development front, I am tracking a couple of potential improvements, with the plan of adding those hopeful performance enhancers to the AK book sometime next year, if all goes to plan.

I hope you were able to avoid the worst of this years troubles. For those currently trapped in longs, help is potentially fast apporaching. One bull hope is the very bullish stance of the Seven Year Cycle, which I updated and published earlier this week.

The other is breakdowns like we’re currently experiencing usually end with a reversal rally back to major moving averages, such as the 200 and 50 days, once the intial sell phase completes. Such a move that is likely to land in the next month or two should offer favorable prices to exit overexposed long positions, and potentially offer a good place to switch to a trend following approach as outlined in the AK book.

Fingers crossed that the worst is behind us, and better times lay ahead, whether the years to follow are mostly bull market - as predicted by the Seven Year cycle - or something far more bearish and prolonged.