AK Chart and Performance Review

Stocks enjoyed a positive surging run into mid-week this week, only for sellers knocking the indexes back down as critically important resistance was challenged. Of the two farmyard and Wall Street foes, the bulls ended happier than the bears, although I’m not sure they have any nails left to chew on.

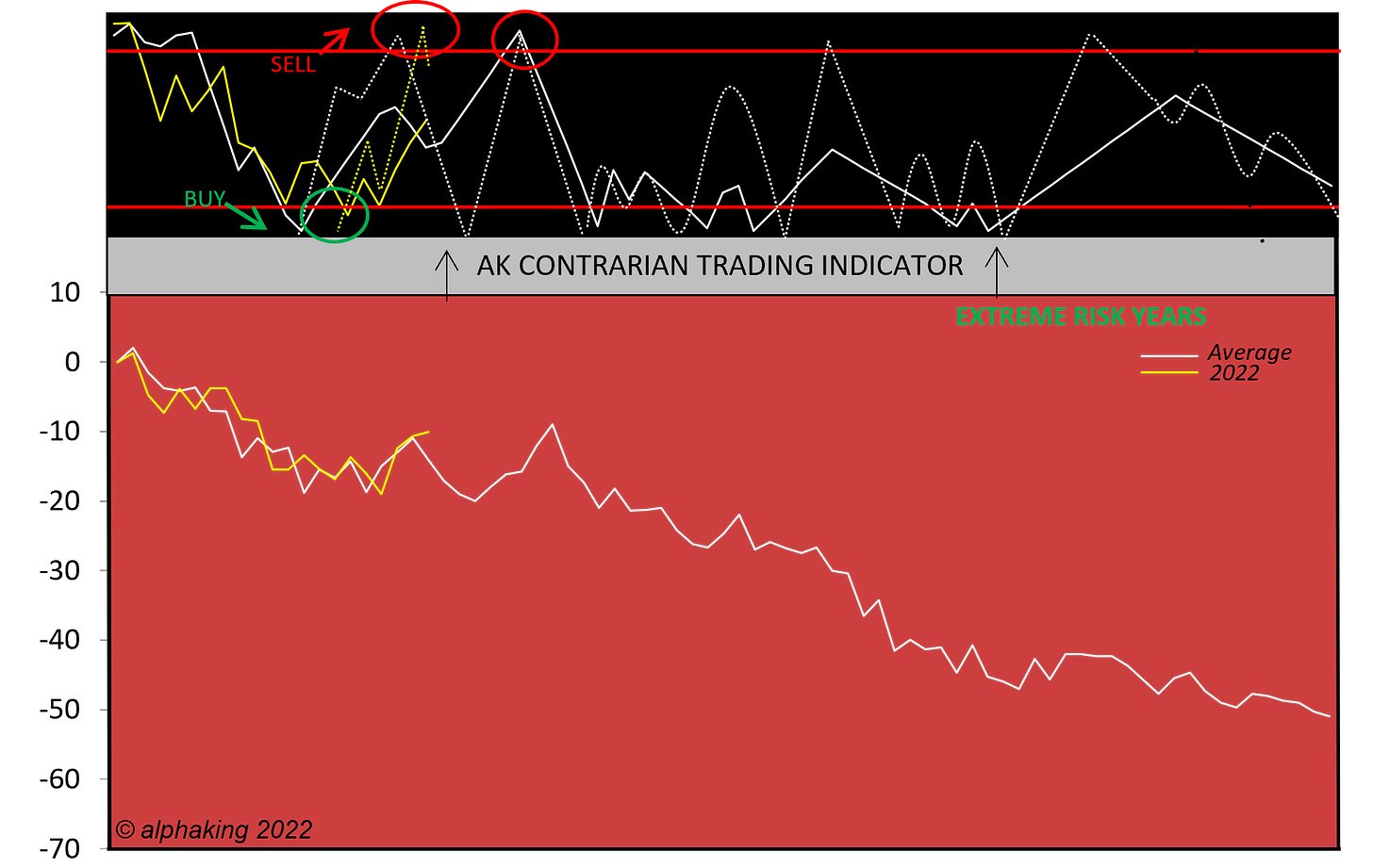

The first chart below shows the expected progress of the NASDAQ in extreme-risk bear phases, which is the part of the cycle we believe we are currently in. The yellow lines of the current NAZ and those of the contrarian trading indicators on top appear to be tracking expectations, with the dotted yellow faster moving contrarian line near the top of the chart closing above, then below, the overbought sell zone this week. That was our cue to take profit on our TQQQ hedge, which we replaced with UVXY. We continue to look for a favorable reversal point to flip our TNA hedge for TZA, although the small caps appear in good shape, so holding TNA remains called for.

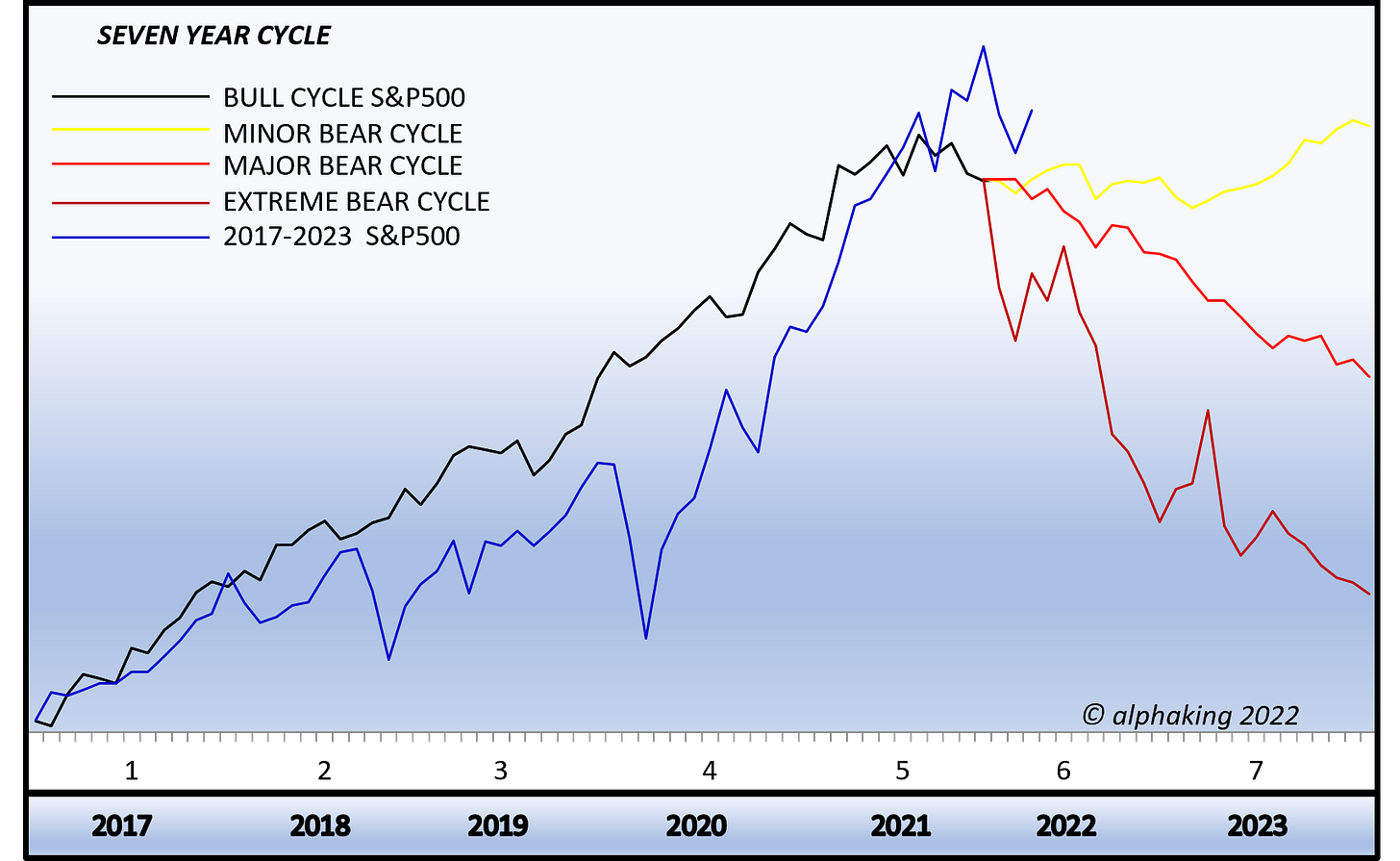

The next chart shows the seven-year cycle we have tracked since 2016 when the last bull phase began. This chart suggests a new bear market is underway. If so, while April likely sees mildly higher prices for a week or two, the eventual low for April should see the S&P500 close on a new low for this bear phase, which should run into late 2023.

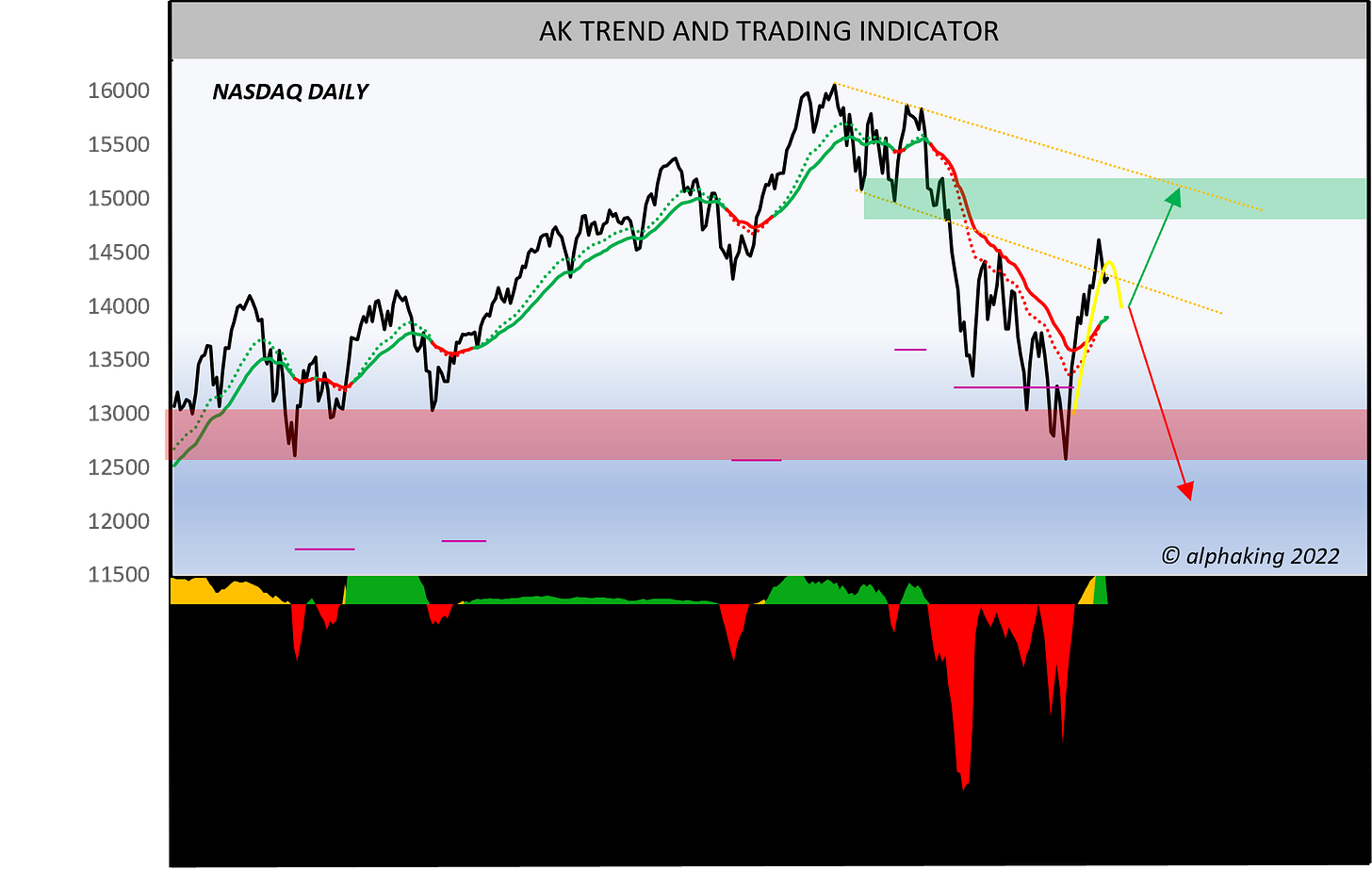

The third chart shows the NASDAQ continuing to follow our yellow line projection above our trend averages, and currently undertaking the pullback to retest those trend averages I warned was coming. The green band remains the eventual target where the bear market likely dies and reverses. The bulls need to smash through that resistance zone to end the bear potential, something which will be extremely difficult for the bulls to pull-off. Since the trend remains up, we will continue to hold our QQQ positions, although hedged to limit any reversal pain, which unfortunately I fear will eventually come. Remember, we trade trends here at AK - adjusting exposure based on risk - rather than anyone’s opinion. The stock indexes rocketing to new highs remains a possibility, and we are on the lookout for signs the bulls are winning this bull/bear war. So far, the bulls are failing in that regard, but that can change, and the up stance of our trend indicators says to give them a chance.

We will publish a Flash Alert Update prior to 3pm eastern time any day new trades are required, with taking profits on our TNA hedge position and flipping to TZA probable next week. We email subscribers whenever we publish such new trade updates.

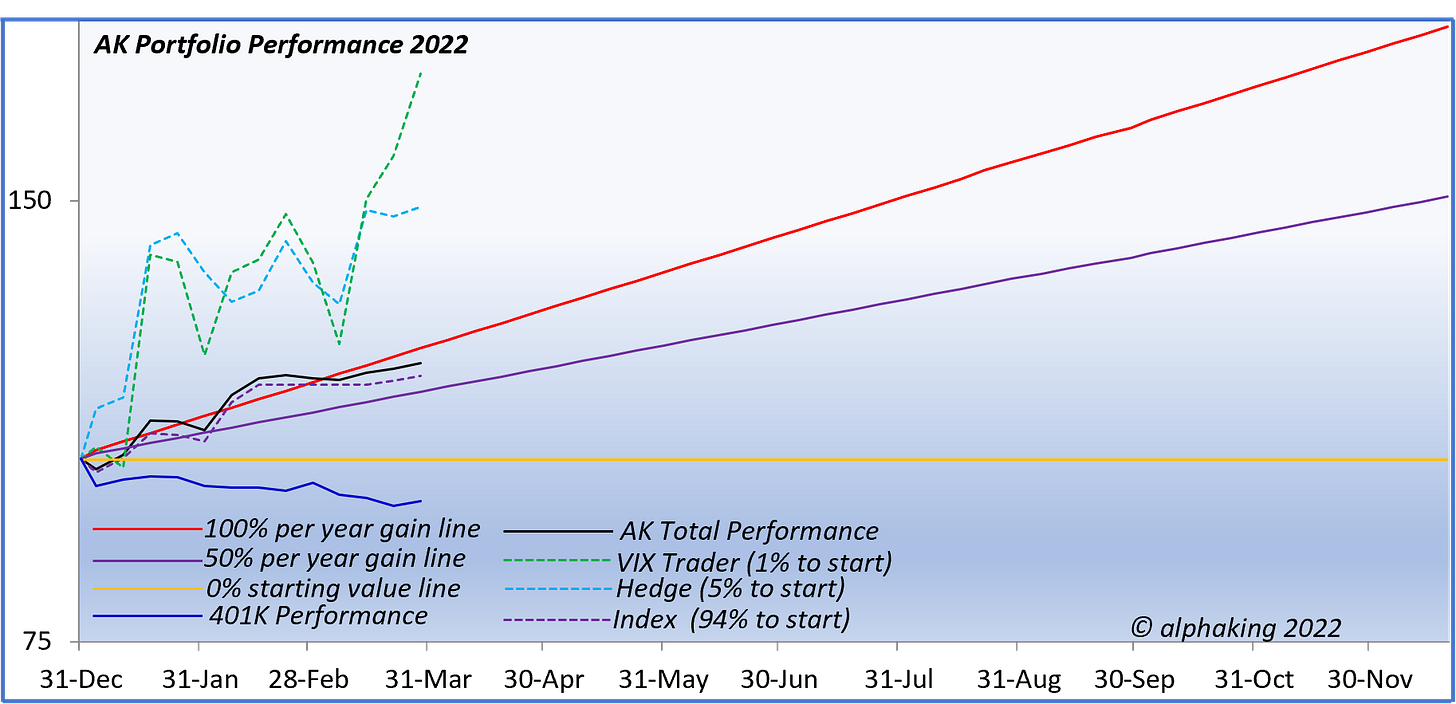

Positioning for the more aggressive Index/Hedge/VIX portfolio strategy remains: 94% QQQ, 5% TNA, 1% UVXY, while the more conservative 401K portfolio remains: 100% QQQ.

Performance-wise, the 401K portfolio is down 6.48% on the year, while the Index/Hedge/VIX portfolio is up 16.22%.

Next update Monday. Have a great weekend!